Credit scores for home buying

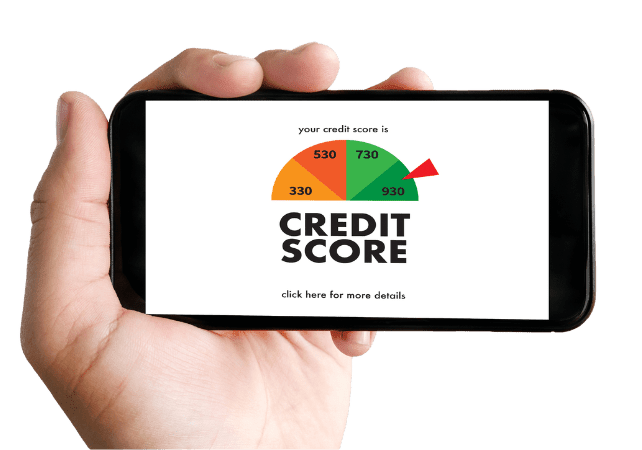

When it comes to buying a home, one of the most crucial factors to consider is your credit score. A credit score is a numerical representation of an individual's creditworthiness, and it plays a significant role in determining whether you are eligible for a home loan. Lenders evaluate your credit score to assess the level of risk they would be taking by lending you money. Therefore, having a good credit score is essential if you want to navigate the home-buying process smoothly.

Understanding the role of credit scores in home ownership

Homeownership is a dream for many, but it requires careful financial planning and responsible borrowing. Your credit score is an important metric that lenders use to determine your creditworthiness and assess your ability to repay a loan. It reflects your history of handling debt, including credit cards, loans, and other financial obligations. By evaluating your credit score, lenders gain insight into your financial habits and determine the level of risk associated with lending to you.

A high credit score demonstrates to lenders that you are a responsible borrower who is likely to make timely payments. This increases your chances of obtaining a favorable interest rate and loan terms. On the other hand, a low credit score may result in higher interest rates or even loan denial, making it more challenging to purchase a home.

Credit score requirements for buying a house

The credit score requirements for buying a house may vary depending on the type of loan and the lender you choose. However, in general, most lenders prefer borrowers to have a credit score of at least 620 to qualify for conventional loans. Federal Housing Administration (FHA) loans, which are popular among first-time homebuyers, may allow borrowers with credit scores as low as 500 to qualify, although a higher score might be required to secure a low-down-payment option.

It is worth noting that while credit scores play a significant role in the home-buying process, they are not the only factor lenders consider. Lenders also assess other financial aspects such as your income, employment history, debt-to-income ratio, and overall financial stability. However, maintaining a good credit score is crucial as it can positively impact your ability to secure a loan with favorable terms.

Importance of Credit Scores in Home Buying

When it comes to purchasing a home, the importance of credit scores cannot be emphasized enough. Your credit score not only determines your eligibility for a mortgage but also affects the interest rate and terms you will receive. A higher credit score can potentially save you thousands of dollars over the life of your loan.

Lenders rely on credit scores to assess risk. The higher your credit score, the less risky you appear to lenders, which increases the likelihood of approval and better loan terms. On the other hand, a low credit score may result in a higher interest rate or even loan denial.

Furthermore, a good credit score demonstrates financial responsibility and the ability to manage debt effectively. This is especially important when purchasing a significant asset like a home. Lenders want to ensure that borrowers have a history of making timely payments and are likely to continue doing so in the future.

Keep in mind that credit scores are not fixed, and they can change over time. Therefore, it is crucial to start monitoring and gradually improving your credit score well before you plan to buy a home. Take proactive steps to establish a solid credit history, such as paying bills on time, keeping credit card balances low, and avoiding new credit inquiries.

In conclusion, credit scores play a vital role in the home-buying process. They affect your eligibility for a mortgage, the interest rate you receive, and the overall cost of borrowing. By understanding the significance of credit scores and taking steps to improve them, you can enhance your chances of becoming a homeowner and save yourself money in the long run.